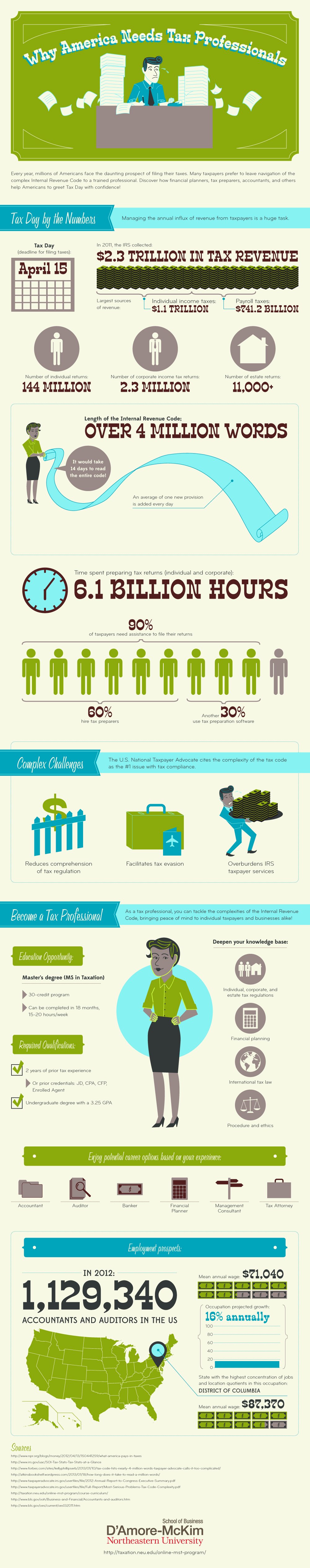

Let’s take a quick break from SEO and social media for a second to talk about taxes. As a professional blogger and webmaster, you are still required to pay taxes on your income. Other revenues generated from businesses, endorsement deals and various sources are also taxed and must be filed properly. For webmasters with a lot of websites or sources of income, taxes can be quite difficult to manage. This is where an experienced tax professional comes in handy.

More and more people – including individual taxpayers with relatively small households – are using the services of tax professionals. Even universities such as Northeastern University are making their top masters in taxation programs more available to accommodate the increasing demand for tax professionals.

The main advantage of getting the assistance of tax professionals is the amount of money you can actually save on your taxes. Just by understanding the regulations properly, you can lower the amount of taxes you pay by as little as 40%.

Learn more by reviewing the Why America Needs Tax Professionals infographic by http://onlinebusiness.northeastern.edu.

Itender Rawat